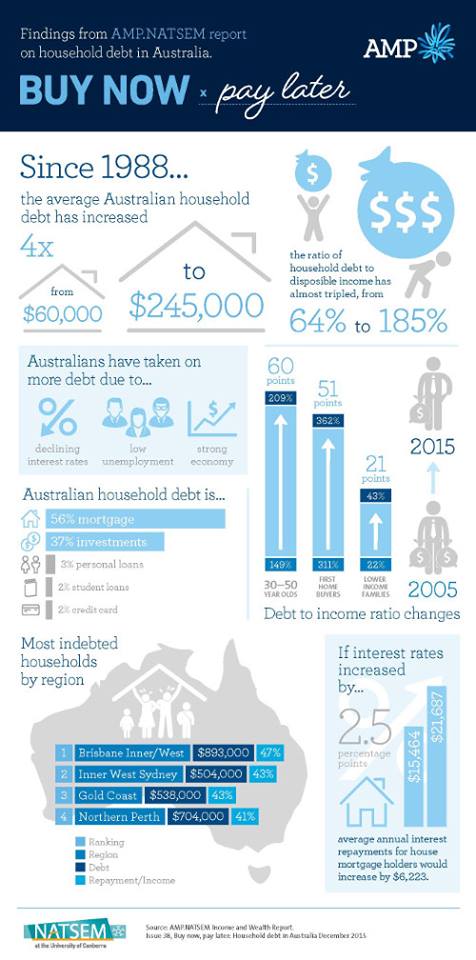

We’ve displayed an infographic courtesy of AMP, outlining the key findings of its recent Household Debt study, which was released on 13 December.

As a financial planner, dealing with families every day, it confirmed what we already know; that debt levels are often higher than clients realise. While we are currently enjoying record low interest rates it appears the situation is manageable. But, without careful debt management and planning, for many there are potentially storm clouds ahead.

Simply put, the key take home point is that debt has increased.

Taking inflation into account, the average household has four times the debt it did 27 years ago. In fact, Australia currently has one of the highest household debt ratios in the world.

This is not always a bad thing. Many Australians are not content to aspire to a retirement on Centrelink, and if used correctly and prudently, debt can assist in reaching financial goals for many. Right now, I would argue this debt is by and large a good thing. Assets purchased through debt has generated wealth, with 90% of it used to buy a home to live in or building wealth, rather than for the purchase of consumables.

Let’s be clear – whilst debt levels have increased over the past 10 years, low interest rates and continued economic growth have left most households in a good financial position.

So far so good, but the current low interest rate environment is not going to continue indefinitely. At some point in the future increasing interest rates are a certainty; they cannot and will not remain at current levels.

According to AMP’s report an increase of 2.5% will cause the average household to make an additional $120 per week in repayments.

Ask yourself, how many of you (or your clients) could comfortably afford a 2.5% interest rates increase let alone 5% (which would bring rates in line with those that seemed normal a decade ago).

If increasing interest rates coincide with an economic downturn and increased unemployment, the need for clients to deleverage will be sudden and brutal.

The solution is obvious – Australian families need help planning ahead. Interest rate increases should be allowed for to ensure they aren’t financially ruined in the future. Repayment of debt through the best use of surplus cashflow is the best protection against the future.

Of course, the downside of such strategies is that we as individuals and families need to forgo short term gratification over long term financial security. This is a difficult psyche to break in the modern “buy now, pay later” world we live in. Difficult, yet financial certainty is almost impossible to achieve without keeping this in check.

Our job is to clearly show the current levels of debt and what impact increasing rates would have. Sexy planning it isn’t but in the long term, our clients appreciate the foresight.

Finally, for those that see this as an Eastern States problem due to escalating property prices over the past 12 months, bear in mind – the region with the fourth highest levels of debt is our own Northern Perth (including Joondalup and Stirling).

Nick Hart is a Financial Advisor with Empire Financial Group. Nick provides clients with goal focussed, strategic financial planning advice, and in addition is a UK Pension Transfer authority.