Borrowing within super to buy property can work — but not always

There are many reasons why using a self-managed super fund to borrow to buy property is gaining popularity.

Investors like being able to use super balances to make a substantial deposit on a property and they know that if the deposit is big enough any rent can cover the interest and holding costs. They are drawn to the idea of using employer and any other pre-tax contributed money to pay off the principal of the loan and understandably like the possibility that any income or capital gains from the property may be tax free once in pension mode.

However, the strategy is not for everyone and there are drawbacks. Generally, residential rental property has a capital growth emphasis and may not provide enough income to meet minimum pension payments in retirement.

Property is a lumpy, illiquid asset and investors are well advised to consider the issues surrounding diversification with so much committed to one single investment. Just like it may not be prudent to invest all your funds in, say, just shares in case the market drops dramatically, so too exists the risk that if property prices plummet then having all your eggs in that one basket is an issue.

Furthermore, for those borrowing, there is also the double-edged sword that while gearing magnifies gains, it can also magnify losses.

It is therefore incredibly important that you seek the right advice before embarking down this path. There are a number of key things to consider. There may be more that are specific to your personal circumstances but here are some to keep in mind:

What do you want your investments to achieve for you? Are you accumulating assets and focussed on capital growth, or looking for steady income streams?

How much longer do you have before you retire?

Will you be relying on your super to assist with paying off debts (like home loans) when you finish work?

How much do you have in your fund and how much can you, or your employer, contribute?

Are you comfortable investing in assets that have fluctuating investment value?

What’s vital is that the strategy and the outcome are considered first, and then the property.

The best property opportunity may not best fit an SMSF strategy if your circumstances don’t suit. Conversely, the best super opportunity may fall apart if the property you buy is all wrong.

And this is the clincher. Quite often we see negative press about unlicensed and unregulated spruikers pushing overpriced property, driven by huge commissions.

Increasingly, they are looking to peddle the property under the guise of SMSF advice.

The all-important question to consider is, what is the end goal of the person providing the “advice”?

If selling the property is the primary driver and the advice is secondary, then stop and consider with heightened caution.

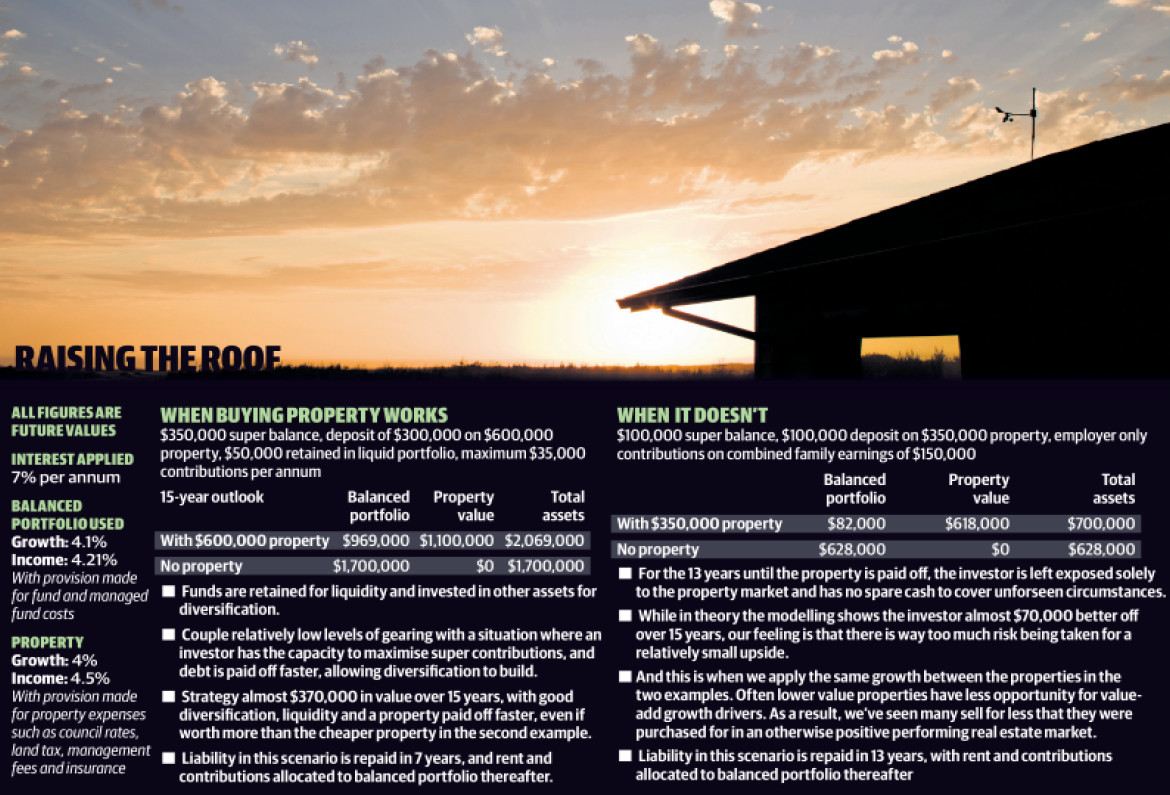

We’ve outlined two examples in this article. Example one outlines the situation where we think there is a sound case for borrowing within super to buy property.

Example two shows where it is not appropriate.

—

—

What we fear, is that when the chickens come home to roost, and investors in these property ventures do not see the returns they’d hoped for (or worse still, they are worth less than they paid for them) will they blame the vehicle holding the asset (super), the sound strategy implemented, or the asset itself?

Our position is neutral. We do not sell property, ours or anyone else’s, but we certainly do not discourage it where the property and the strategy are right for the client.

Where it is appropriate, and clients demonstrate experience or an interest in property investment, we will absolutely consider the best possible tax structures and funding vehicles for that, and often SMSF is just that. Buying the property is then up to you — tread carefully. That decision will make all the difference to a successful or disastrous use of superannuation to hold your investments.