The story of the first half of 2023 has been the incredible rebound in international share markets despite all manner of headwinds and crises.

Central banks have continued to tighten the screws by raising rates, bond markets appear to be pessimistic about the future, and although it already feels far distant, March saw one of the worst banking crises to hit developed markets since the GFC.

Despite this, broad measures of international markets were up by well over 10% in the six months to June, with most of that gain coming in the last three months.

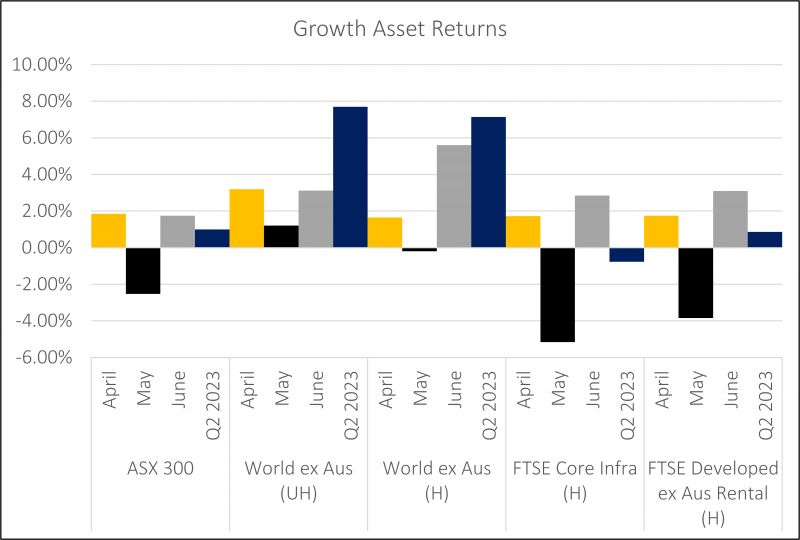

Empire’s Balanced Growth and Growth models delivered returns that sat between Australian and Global equities, while the Balanced Income model delivered the same return as the ASX200 over the quarter. These returns reflect the diversified nature of our underlying asset mix.

Gains have been narrowly concentrated, however. Investor enthusiasm over the potential for artificial intelligence to be a transformative technology has driven the market. The tech heavy Nasdaq, which hosts AI or AI-adjacent companies like Apple, Meta, Nvidia and Alphabet was up by over 40%. The rest of the market accounted for a relatively small portion of all market gains. Countries like Australia, which does not have a well-developed technology sector, saw paltry gains in comparison. The ASX200 was up by about 4.4% over the same period.

Bond markets had more muted performance. Australian and global markets both lost ground over the quarter, as central banks continued to raise rates in their fight against inflation. Bonds continue to show a very high level of volatility relative to their history, as traders continue to adapt to this new era of higher rates, rapidly changing conditions and, despite some success by central banks, the highest and stickiest inflation environment in decades.

Diversifying assets have continued to struggle relative to traditional bond and equity markets. Listed infrastructure and property markets delivered small positive returns but trailed far behind equity markets, detracting from relative absolute returns. Alternative strategies, depending on the approach they take, delivered a range of outcomes. Trend-following managers tended to deliver positive returns that beat the Australian share market but trailed global shares. Real return type funds, reflecting the outlook of the bond market, tended to be positioned conservatively and failed to pace equities. After a strong start to the year, gold gave up ground in the quarter to June.

Source: Vanguard

At Empire, we are evolving the way we invest our client’s hard-earned savings as a result of the structural changes currently shaping our markets and economies. We are always looking out for ways to adapt our portfolios to current market conditions. In the landscape today, we are considering the following themes:

- Cash is a competitor. Rising short term interest rates have led to an environment where cash and other types of shorter tenor bonds are offering returns that are comparable to longer tenor and riskier bonds. After a long period of time during which cash investments paid almost nothing, cash and lower risk investments are now once again serious contenders in portfolio construction.

- Diversification is important. Alternative investments remain an important tool in the kit. Alternatives, which generally have a lower sensitivity to bond and equity markets, can be difficult to hold on to when traditional assets do very well. However, over the long term their role of reducing volatility and depth of drawdowns remains critical.

- Evolving portfolios to align with our philosophy. Over the quarter we continued to shape our portfolios to better align with how we think about markets. The addition of a concentrated, activist share strategy is an excellent representation of the type of strategy we believe will add value for our clients over the long term.