News in the first quarter of 2023 has been dominated by stress in the financial sector. Central banks across the world have been engaged in an unprecedented cycle of rapid, synchronous rate rises. The rate hike cycle kicked off in response to a burst of inflation initially generated by supply chain snarls caused by the COVID crisis. And though the composition of inflation seems to be changing, the response by central banks seems to have been effective at slowing overall inflation.

While the efforts of bankers have in some ways therefore been validated, there have been repercussions as well. Silicon Valley Bank, Credit Suisse, and a host of small regional banks have all failed or come under severe pressure. Though the causes for each bank failure differ in the details, all are related to rapid rises in interest rates.

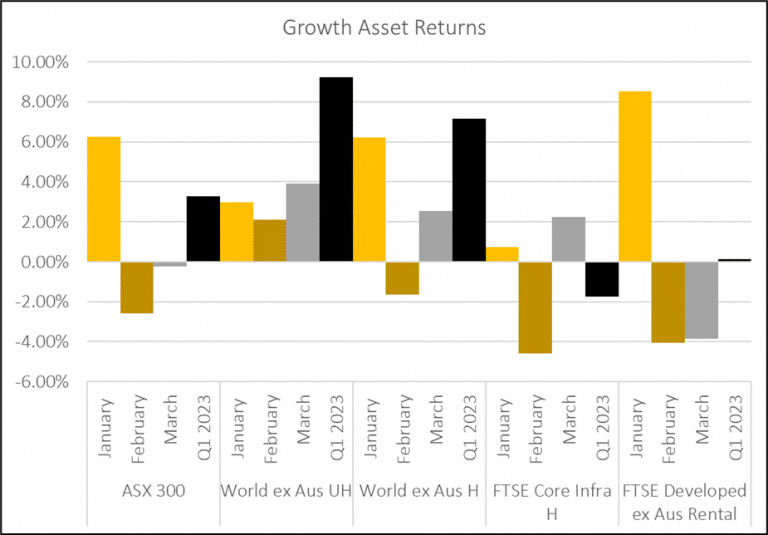

Perhaps surprisingly then, equity markets posted gains over the quarter, including a positive return in the tumultuous month of March. Share markets also had a strong January but retreated in February. Traditional bond markets also had a strong quarter. Concerns about the health of the global economy led to a drop in yields early in the year. In March, investors sought the relative safety of bonds as they feared the worst following the banking scare, leading to a very strong March. It’s worth emphasising the magnitude of events in March; yields on 2 year US treasury bonds posted their greatest three day decline since the Black Monday crash of 1987.

Diversifying assets did not fare as well to start the year. Lower duration, credit-focused fixed income strategies, which are less sensitive to changes in interest rates, lagged behind sovereign bonds. Infrastructure, which held up well during 2022, delivered a negative return. Listed property markets were flat, continuing a run of underperformance relative to broad equity markets. Alternative strategies, depending on the approach they take, delivered a range of outcomes. Gold performed very well, while more momentum-based strategies struggled as certain markets whipsawed.

Each of Empire’s models delivered on their CPI-linked return objectives over the quarter. The Balanced Growth and Growth models delivered returns that sat between Australian and Global equities, while the Balanced Income model had a return that was in line with global bond markets.

At Empire, we are evolving the way we invest our client’s hard-earned savings as a result of these deep, structural changes to markets and economies. The higher interest rate world we are returning to has implications for the way we think about portfolio construction, especially as it applies to bonds. We are always looking out for ways to adapt our portfolios to current market conditions. In the landscape today, we are considering the following themes:

- Cash is a competitor. Rising short term interest rates have led to an environment where cash and other types of shorter tenor bonds are offering returns that are comparable to longer tenor and riskier bonds. After a long period of time during which cash investments paid almost nothing, cash and lower risk investments are now once again serious contenders in portfolio construction.

- Evolution of bond portfolios. We have been modifying the composition of our bond portfolio in response to rising interest rates. As rates rise, bonds have the capacity to play their traditional role in investment portfolios. We have been cautiously moving our bond portfolios to reflect this, though we note the picture is complicated by high inflation,

- Diversification is important. Alternative investments remain an important tool in the kit. Alternatives, which generally have a lower sensitivity to bond and equity markets, can be difficult to hold on to when traditional assets do very well. However, over the long term their role of reducing volatility and depth of drawdowns remains critical.