by Katie McDonald.

Most articles regarding women and finance tend to be based on the disappointing and alarming statistics relating to the disparity between us and our male counterparts. This especially rings true when it comes to the gap in our salaries and super balances. As a long term advocate of the importance of financial literacy amongst women, I know very well it is a powerful story that requires telling.

However, what may come as a surprise is that women are taking control of their finances and in some areas outperforming the men.

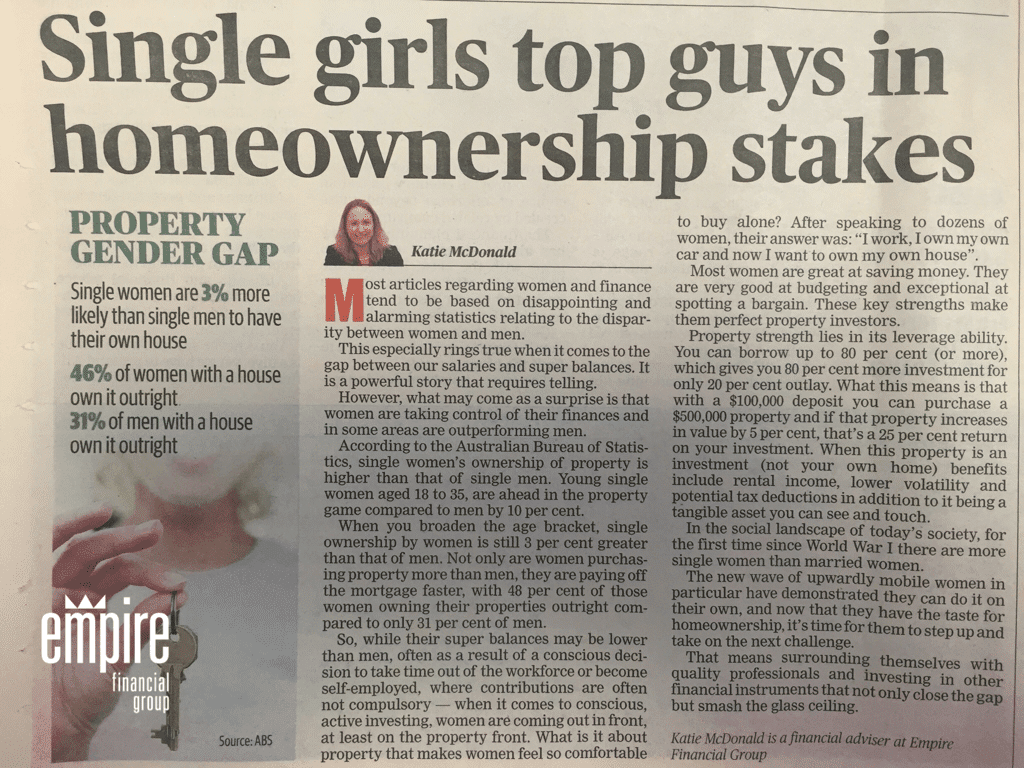

According to the Australian Bureau of Statistics, single women’s ownership of property is higher than that of single men. In fact, young single women 18-35, are ahead in the property game compared to men by 10%. When you broaden the age bracket to cover women of all ages, single ownership by women is still 3% greater than that of men. Not only are women purchasing property more than men, they are paying the mortgage off quicker, with 48% of those women owning their properties outright compared to only 31% by men.

So, while their super balances may be lower than men, by default, and often as a result of a conscious decision to take time out of the workforce, or become self employed where contribution are not compulsory, when it comes to conscious proactive investing, women are coming out in front, at least on the property front.

What is it about property that makes women feel so comfortable to buy alone?

After speaking to dozens of women who have purchased their own property, their answer was quite simple. I work, I own my own car and now I want to own my own house.

Most women are great at saving money. They are very good at budgeting and exceptional at spotting a bargain. These key strengths make them perfect property investors.

What is so good about property? And now that women have taken this step and become homeowners, what’s next?

Property strength lies in its leverage ability. You can borrow up to 80% (or more), which gives you 80% more investment for only 20% outlay. What this means is that with a $100,000 deposit you can purchase a $500,000 property and if that property increases in value by 5%, that’s a 25% return on your investment. When this property is an investment (not your own home) benefits include rental income, lower volatility, and potential tax deductions in addition to it being a tangible asset you can see and touch.

In the social landscape of today’s society, for the first time since World War 1, there are more single women than married women. Women are choosing to not get married or marrying later, are outliving men and unfortunately divorce rates remain high. With the above in mind women need to take control of their financial future. The new wave of upwardly mobile women in particular have demonstrated they can do it on their own, and now that they have the taste for homeownership, it’s time to step-up and take on the next challenge. That means surrounding yourself with quality professionals and start now to apply the same principals and invest in other financial instruments and not only close the gap, but smash the glass ceiling.

Katie McDonald is a financial adviser at Empire Financial Group and is an expert on financial education for women.