We are proud to share with our valued clients that Empire have launched a new suite of investment portfolios specifically designed with our clients in mind to be more resilient and responsive to the dynamic market environment that is presented to us.

The ability for us to create these portfolios, access some of the best investment expertise and capabilities, and have it delivered to our clients at a competitive rate has been the culmination of almost a year’s work, and the scale that Empire now has to negotiate terms on our client’s behalf.

We are a living in an uncertain world. Interest rates at record lows, ongoing central bank interventions and high equity market valuations are all complicating factors on the path to recovery in a post-COVID19 pandemic world.

Traditional methods of portfolio construction come under increasing pressure.

To uncover opportunity, to build portfolios robust and resilient for the future that are also the right fit for our clients, we have taken the strategic decision to enhance our investment proposition through appointing an asset consultant. An asset consultant advises on investment governance, strategy, portfolio construction, manager selection and implementation.

The right choice for Empire and our clients

At Empire, we pride ourselves on being completely investment agnostic. We take an objective approach to investment selection and have no bias towards any type of investment.

Naturally when it came to choosing an asset consultant to help us construct a new suite of portfolios, it was important to us to ensure we diligently selected the right partner.

To do this, we undertook an extensive search inviting 5 asset consultants based across the country to submit tender responses to a request for proposal. Following a thorough review of the capability, experience and approach of each group, the Empire Investment Committee decided to appoint Context Capital to support our portfolio construction and investment activities.

Context Capital was founded in 2020 by the former investment team of WA Super who were responsible for managing in excess of $4 billion. Context is supported by a highly regarded advisory panel and best in class partnerships with institutional consultants and technology providers. Context is led by Chris West, a finalist in the 2019 Conexus Chief Investment Officer of the Year Awards and regular contributor to local and national financial media and investment conferences. Context provides investment consulting to a select number of financial advice firms, family offices and boutique institutions, primarily in WA. Being based in Perth means we are able to have a deep strategic relationship with Context to deliver increased value for our clients.

To strengthen the partnership, Context invited our Managing Director, Raymond Pecotic, to sit on their advisory panel as the ‘voice of the client’ for Context’s service and product development.

Our investment philosophy and differentiation

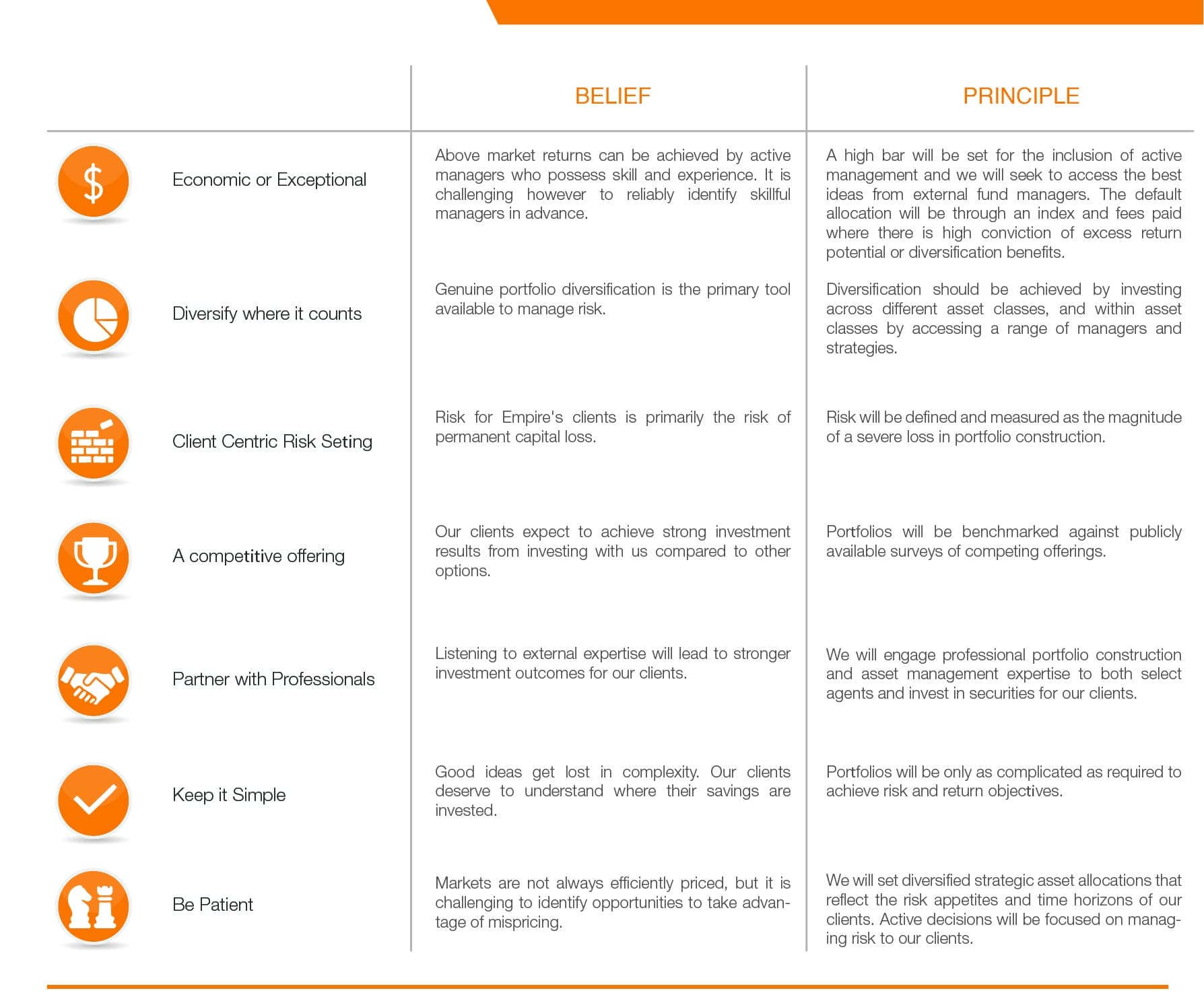

In the past 6 months, the Empire team have invested a significant amount of time through a series of workshops with Context to clearly identify and articulate our investment philosophy that reflects our clients’ needs and objectives. This is outlined in the figure below

The Empire Investment Philosophy

These beliefs and principles guide our portfolio construction and investment selection for our clients.

Building Portfolios

We have constructed a new suite of enhanced investment portfolios. Some of the features of these portfolios are that they are:

- Diversified

- Professionally Managed

- Value for Money

- Designed with our clients in mind

- Customised

- Exclusively available for clients of Empire Financial Group

To implement our enhanced investment portfolios, we have decided to implement them via separately managed accounts rather than model portfolios. The benefits of separately managed accounts for our clients are:

- The portfolios are regularly rebalanced taking advantage of the benefits of ‘buying low, selling high’

- Access to lower fee arrangements with fund managers, becoming a ‘price maker not a price taker’

- Access to incorporate diversifying strategies not readily available using model portfolios

- Ongoing professional management of the portfolio so we can respond to market conditions in between our review meetings with you

We will be assessing the suitability of these portfolios with our clients on an individual basis, however in the interim, if you have any queries, please contact your adviser on 9323 3000 to discuss further.