PORTFOLIO MANAGER COMMENTARY

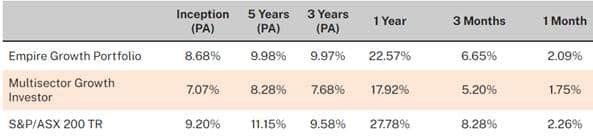

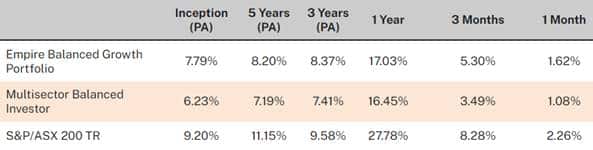

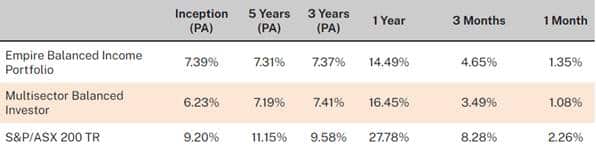

Empire’s Growth, Balanced Growth and Balanced Income Funds delivered a strong result over June, returning 2.09%, 1.62% and 1.35% for the month respectively. Over the March to June quarter, returns for the Empire Growth fund have been 6.65%, the Empire Balanced Growth 5.30% and the Empire Balanced Income Fund 4.65%.

Monthly performance across all three funds was primarily driven by Empire’s allocations to Global equities and Global property. Focussing on global shares, Aoris returned 3.44% for June, outperforming its benchmark by 1.3%. T.Rowe Price delivered outperformance of 2.6% relative to the hedged MSCI ACWI ex Australia return of 2.2% for June.

Empire’s Alternatives and Real Asset portfolios also contributed to monthly performance. Property had a strong month, with the Quay Global Real Estate Fund returning 4.84%, while Empire’s gold allocation gaining almost over 3%.

Strategies specific to the Balanced Income Fund delivered on their specialised roles in the portfolio over the month. Ausbil’s Active Dividend Income underperformed its ASX benchmark in terms of total return, however the strategy still contributed a strong distribution return of 1.05%. Bentham’s Global Income strategy underperformed its return benchmark but still contributed a strong distribution return of 1.07%.

At a total portfolio level, all of Empire’s three managed portfolios outperformed Morningstar’s Balanced fund over June and longer-term returns continue to track higher due to a combination of manager selection and a structurally lower weighting to cash in Empire’s portfolios.

Below you will find tables summarising performance the Empire Growth, Balanced Growth and Balanced Income funds, and comparisons to the Morningstar and S&P ASX 200 benchmarks.

For a more detailed summary of the respective portfolios please click on the links below:

Empire Growth Portfolio

https://live.quantreports.com/report/empire-growth-portfolio

Empire Balanced Growth Portfolio

https://live.quantreports.com/report/empire-balanced-growth-portfolio

Empire Balanced Income Portfolio

https://live.quantreports.com/report/empire-balanced-income-portfolio

ECONOMIC & MARKET COMMENTARY

Stock markets in the US rounded out the first half of 2021 close to or at record highs as the economy continued to pick up the pace with more people returning to work. Monetary and fiscal stimulus remaining at historic levels provided a consistent tailwind to markets, and there’s little to show either will be removed any time soon.

In Australia, the ASX200 gained +26.9% in the 12-months to June 30 2021, while the All Ords Index had its best year since 1987 in the same period. YTD, the ASX200, has gained around +11%, showing a slightly weaker second-half performance. On the final day of trading on June 30, the ASX200 index closed at 7,313 points, up slightly on the day.

The benchmark S&P500 finished the first half with a total return of above 15% after a lacklustre start in January, stringing together five straight months of gains.

June’s US FOMC (The Fed) meeting saw the committee surprise the market with a slightly more hawkish tone, as they indicated that the first rise of interest rates was ever so closer in late 2023, and tapering of the bond-buying program may be closer than some expected. The move triggered a change in risk appetite as Growth stocks firmed and Value lagged, while the yield on long-dated US Treasuries declined slightly. Inflation has risen sharply in recent months, and the Fed is signalling that not all price increases will be transitory, as previously mentioned.

June 2021 Summary:

- The ASX200 gained +2.2% for the month and set the strongest 12-month return to June 30 since 06/07 with +26.9% for the 12 months

- Yields on the benchmark 10Y government bonds finished the month at 1.45% in the US (-13bps) and 1.53% AU (-11bps).

- The AUD weakened against the USD by around -3% in June, hovering around the 0.75 level.

- The jobs market in Australia continues to improve with the unemployment rate falling to 5.1%, and 115,000 new jobs added

- US equity benchmarks continued to probe record highs in June and finished H1 strongly

- The US Fed reiterated its commitment to the current policy settings despite a slightly hawkish surprise at the June FOMC meeting

- Yield spreads and rates experienced volatility after the June FOMC meeting

- The US dollar experienced its biggest monthly gain in June since late 2016

- Growth came back into favour after two consecutive quarters of underperformance vs Value

Australian Economy:

Business conditions and consumer sentiment remain historically high in Australia. The recent lift in the data, including the NAB business survey, makes a case that the impact from recent state-based lockdowns has been somewhat limited. The jobs market continues to show improvements and is on track to reach the RBA’s target rate of unemployment by year-end. Employment in Australia is now back above levels since the pandemic began, and we are starting to see early signs of labour shortages, which is yet to translate into wage growth, but this might not be far away. Wage growth gained a modest +1.4% in Q1 2021.

US Equity Sector Analysis:

Interest rate-sensitive Financials declined -3% in June after a more hawkish FOMC meeting, after a four-month streak of healthy gains. For the first half of 2021, REITs (+22.4%), Financials (+25.3%) and Energy (+45.1%) were the best-performing equity sectors in H1, following on from 2020 when they were coincidentally the three worst performing sectors for the year. Utilities (+2.3%) and defensive staples (+4.8%) lagged in the first half of 2021. Tech gained ground on the late rotation back towards Growth (+13.2%) YTD. WTI has posted its fifth consecutive quarterly gain and posted a staggering (+51.2%) gain in H1.

Looking Ahead:

There are a number of mixed signals being given by markets and many possible risks to the recovery, and never a shortage of discussion about how those risks will unfold. Inflation in the US is running well above the Fed’s 2% inflation average, which gives plausibility to reducing fiscal and monetary stimulus sooner rather than later. On the flipside, market inflation measures have been trending lower such as long-dated US treasuries, which peaked back in April—supporting the argument that the rising inflation we are seeing might just be transitory and could peak soon.

US stock markets are pushing record highs, but fewer individual equity names are responsible for the gains. After the S&P500 broke out from the consolidation in May, only 4% of companies within the index made new highs, leaving many investors scratching their heads. Seasonality is also worth considering in the coming months.

Overall the momentum in the economy is favourable and bodes well for the growth in the second half of 2021, with consumer sentiment and business surveys remaining elevated. While the second half of the year could provide more volatility to markets, the historic levels of monetary and fiscal accommodation should give good support to the economic reopening trade along with a rotation back into Value.