- Empire Financial Group’s flagship Separately Managed Account models have continued to deliver strong absolute and relative performance through the March 2022 quarter with outperformance of between 0.94% and 2.26% in the quarter, between 2.85% and 4.10% over 12 months.

- The March 2022 quarter was an eventful one for markets. Markets over the quarter were significantly impacted by Russia’s invasion of Ukraine, the ongoing supply chain disruptions from COVID and the vaccination led recovery along with Central banks beginning to raise interest rates potentially as part of a significant tightening cycle.

- In the quarter markets experienced repricing of risk assets following rising medium term interest rate and inflation expectations, one of the worst returning quarters for government bonds in history and one of the best returning quarters for commodities in history.

Figure 1: EFG Portfolio Performance

Market and Strategy Highlights

Equities

The ASX was a stand-out performer in the March quarter, with our commodity heavy index up 0.7%. More broadly in equity markets:

- The FTSE in the UK also rose modestly, up by 0.5%

- The S&P 500 was down 4.6% for the quarter

- European markets were down 7.7%

- The TOPIX in Japan was down by 1.2%

- Value outperformed growth significantly in the quarter (-0.7% to -9.6%) measured by MSCI World in USD.

Our client equity portfolio configurations generally have been positioned with a quality-growth bias as our view is this is the most suitable way to deliver long term consistent excess returns, with a value bias being a more transient and potentially capped return source. This approach has generally weighed down on the performance of our client’s portfolio in the quarter, as T. Rowe Price and Aoris both meaningfully underperformed relative to their benchmarks. However our portfolios do have a meaningful home country bias which, in this case, has contributed to returns in the quarter as the Australian market outperformed most global markets due to commodity exposures.

Fixed Income

As flagged in previous quarterly reviews, we have been concerned about the risk of rising interest rates and the potential impact on bond markets and resulting negative returns.

This risk eventuated in the first quarter of 2022 as:

- Australian 10 year government bond yields rose from 1.67% to 2.77% delivering a -6.1% return for Australian government bonds in the quarter

- US government bonds delivered a -5.2% return

- UK government bonds delivered a -7.4% return

- German bonds delivered a -4.9% return

- Japanese government bonds delivered a -1.7% return

These are not the returns to be expected of a ‘defensive’ asset and the earlier decision for our clients to have materially reduced duration exposure and reconfigured fixed income portfolios has added material value.

Other Assets

The most notable asset class in the March 2022 was commodities with Russia’s invasion of Ukraine amplifying existing concerns over inflation pressures as both the war and resulting sanctions on Russia impacting Oil, Gas and food markets given those nations’ role in the supply of these commodities. Notable rises include:

- Oil of 30%

- Natural Gas of 58%

- Gold +7.7%

- Wheat +29%

- Soybeans +21%

- Corn +26%

Whilst these rises were significant, in some cases the increases were even greater during the quarter.

For Empire Financial Group client portfolios, a stand-out performer was the alternatives allocation to Man AHL Alpha which delivered a return of +6.85% for the March quarter.

Going Forward

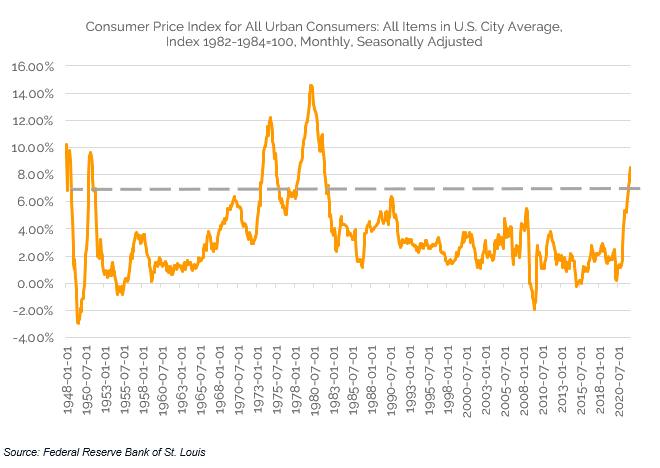

The US unemployment rate dropped from 3.8% in February to 3.6% in March. Australia’s is now 4.0%. A constrained labour market in economies like the US and Australia is putting upwards pressure on wages at the same time there is upwards pressure on prices from supply issues. The annual US inflation rate, as measured by the consumer price index, hit 8.5% in March with Australia’s at 3.5% as of December 2021. Inflation and geopolitics are likely to have a significant impact on markets in the medium term.

Figure 1: US Inflation

Additionally, there are three key themes influencing portfolio construction and investment selection:

- Less globalisation and more localisation. Post-GFC populism as typified by Brexit and the rise of Trump with the associated trade wars appears to have been the start of a trend against globalisation where more and more countries push towards localisation. The COVID-19 pandemic exposed weaknesses in the incumbent approach and has accelerated this which is even further compounded by Russia’s invasion. Less globalisation means less global competition and more inflationary pressure.

- Continued and escalating geopolitical risk. There is an acceleration away from the unipolar western democratic world towards the bipolar world split into the democratic world led by the USA and the autocratic world led by China (we note this is a massive simplification of very complex issues but the high level trend is clear). The invasion has clearly highlighted global political fault lines and the awkward situation some major economies such as India find themselves in.

An acceleration towards decarbonisation. The EU plans to accelerate energy independence with energy saving measures and increased renewables to reduce the requirement for Russian gas. Other nations are likely to also seek energy independence and security with longer term renewables investment, particularly combined with increasingly efficient storage more attractive when there is a national security benefit on top of the environmental considerations. Nuclear is likely to be considered by many as well. Those unconcerned with the providence of gas can lower their coal dependency by purchasing discounted Russian gas to also reduce their emissions (e.g. China).