Often market outcomes are not driven by hard facts, but instead by emotion and the fear of what may occur rather than what has, or history has told us, is likely to happen. This is normal, and part of our human makeup. Earthquakes, tsunamis, power plant explosions, wars – and health scares – are unpredictable events that rattle our psyches, but also, affect economies and businesses. The now very well publicised coronavirus outbreak has put travel into shutdown, quarantined people, blocked supply routes. It’s led to astonishing feats like the construction of an entire new hospital in less than 10 days in China. The effects of the outbreak may push China’s economy, and others that trade with it, into a period of slower growth, and stock markets worldwide have shed value as investors seek protection. So, how does this affect your portfolio?

Previous Epidemics and your Investments

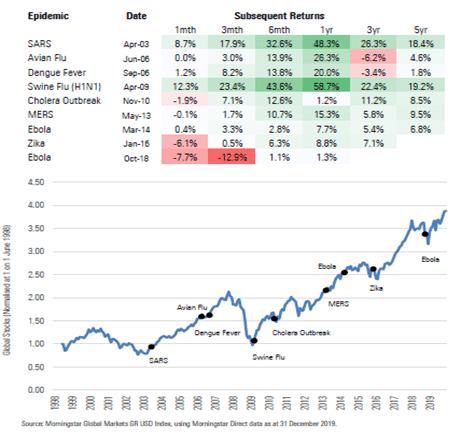

To understand the impact of this outbreak, we need to make an assessment of how the market will behave into the future, and this is fraught with danger. That is because an epidemic does not have a finite start and end date, like an earthquake or other natural disaster. In a one off event like that, we can model out the damage, the impact it will have on production, economic growth, supply chains, and end consumer spending. An epidemic like this however is forever evolving, and data indicating it is turning for the worse can be delivered at any time, changing the forecasts and feeding into investors emotions and fears further. No one can predict the future, but plenty of research suggest ways that forecasts can be improved. Data we have received from Morningstar suggests that one way to improve the accuracy of a forecast is to start with base rates. They ask “How often do outbreaks become epidemics?” and “What effect do epidemics have on economies or markets?” For this latter question, Morningstar have produced data displayed below in Graphic 1 to provide a sense of base rates—market returns following major epidemics in recent history. The graphics below show that historically investors tend to react to epidemics, but the long-term picture is positive.  What history has shown us, is that while early responses to such epidemics lead to significant volatility in the markets, they tend to recover by the six-month mark. This suggests that sentiment drives early losses, but sustained economic impacts are less than perhaps investors feared at the onset. As mentioned previously, the difficulty in predicting how this particular outbreak will impact markets is in not knowing finite end data. Experts may try to produce forecasts on spread rates and mortality rates, but they don’t know what factors may lead to the wider spreading of the virus. So how do we assess what to do next? At Empire, we do not see ourselves as speculators or traders. We make strategic asset allocation based on your circumstances and risk tolerance and invest for long term value. Therefore our greatest concern is whether the long term fundamentals to a company’s sustainable earning capacity are in doubt. For example, will the collective impact of the outbreak (fewer flights, less trade, loss of productivity, etc.) affect a few businesses, a few industries, or entire markets? At this stage, there is no evidence to suggest that this outbreak will behave any differently to other recent epidemics, so we are not sounding any alarm bells. Remember that there is danger in selling out of markets at a time like this, as we would be triggering losses at a low point in the market, and potentially missing out on a rebound if the virus were to be contained quickly. So we want to proceed by assuming what we consider to be the most likely scenario, while taking other possible outcomes into account. Ultimately, we are very cautious but aren’t taking any sudden, knee jerk reactions, either to buy into or out of the markets, and are continuing with our core strategy of buying constantly, consistently and conservatively. We remain cautious and vigilant and will update you should that position change.

What history has shown us, is that while early responses to such epidemics lead to significant volatility in the markets, they tend to recover by the six-month mark. This suggests that sentiment drives early losses, but sustained economic impacts are less than perhaps investors feared at the onset. As mentioned previously, the difficulty in predicting how this particular outbreak will impact markets is in not knowing finite end data. Experts may try to produce forecasts on spread rates and mortality rates, but they don’t know what factors may lead to the wider spreading of the virus. So how do we assess what to do next? At Empire, we do not see ourselves as speculators or traders. We make strategic asset allocation based on your circumstances and risk tolerance and invest for long term value. Therefore our greatest concern is whether the long term fundamentals to a company’s sustainable earning capacity are in doubt. For example, will the collective impact of the outbreak (fewer flights, less trade, loss of productivity, etc.) affect a few businesses, a few industries, or entire markets? At this stage, there is no evidence to suggest that this outbreak will behave any differently to other recent epidemics, so we are not sounding any alarm bells. Remember that there is danger in selling out of markets at a time like this, as we would be triggering losses at a low point in the market, and potentially missing out on a rebound if the virus were to be contained quickly. So we want to proceed by assuming what we consider to be the most likely scenario, while taking other possible outcomes into account. Ultimately, we are very cautious but aren’t taking any sudden, knee jerk reactions, either to buy into or out of the markets, and are continuing with our core strategy of buying constantly, consistently and conservatively. We remain cautious and vigilant and will update you should that position change.